SOL Price Prediction: Will SOL Hit $200 Amid Bullish Technicals and Ecosystem Growth?

#SOL

- Technical Breakout: SOL trades above all key moving averages with MACD suggesting bullish momentum

- Institutional Adoption: ETF filings and Nasdaq-listed company involvement boost credibility

- Network Growth: Rising activity and strategic partnerships (Coinbase-Squads) fuel demand

SOL Price Prediction

SOL Technical Analysis: Bullish Momentum Building

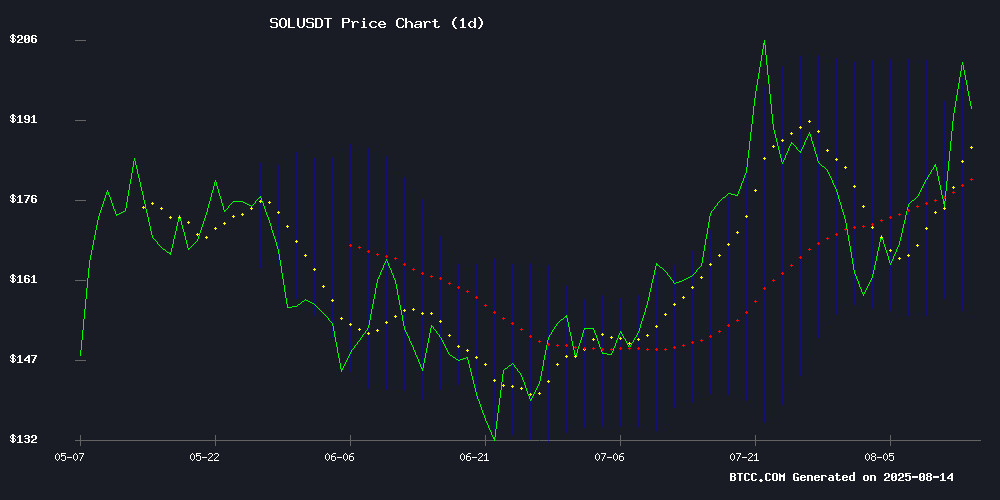

SOL is currently trading at $192.75, showing strong bullish momentum above its 20-day moving average of $177.43. The MACD indicator, while showing a negative histogram (-2.7051), has both the MACD line (2.6912) and signal line (5.3963) in positive territory. The price is testing the upper Bollinger Band at $199.63, suggesting potential resistance. According to BTCC financial analyst Michael, 'SOL's position above all key moving averages and its approach toward the upper Bollinger Band indicates strong buying pressure. A sustained break above $200 could trigger further upside toward $225.'

Market Sentiment: Solana Ecosystem Gains Momentum

The solana ecosystem is buzzing with positive developments: whale activity shows profit-taking but also new deposits ($8.19M to Bybit), institutional interest grows with Nasdaq-listed Upexi appointing Arthur Hayes for Solana strategy, and the SEC is reviewing a spot ETF filing. BTCC's Michael notes, 'The combination of technical strength and fundamental catalysts - including the Coinbase-Squads partnership and new KS Coin loyalty rewards - creates perfect conditions for SOL to challenge the $200 level. Network activity and institutional adoption are becoming key price drivers.'

Factors Influencing SOL's Price

Solana Whale Takes $2.93M Profit Amid Market Rally, Deposits $8.19M in SOL to Bybit

A significant solana whale has moved 39,875 SOL ($8.19M) to Bybit, capitalizing on a $2.93M profit after holding the tokens for five months. The whale originally acquired the SOL for $5.26M on the same exchange, benefiting from Solana's recent 30% price surge.

Market activity among large holders has intensified as Solana's rally—driven by DeFi adoption and cross-chain integration—creates liquidity opportunities. The daily Relative Strength Index (RSI) at 67 indicates strong bullish momentum without extreme overbought conditions, while an On-Balance Volume (OBV) of $607M reflects sustained demand.

Profit-taking by whales underscores confidence in Solana's fundamentals, even as technical metrics suggest room for further upside. The asset's resilience mirrors broader institutional interest in layer-1 blockchains with robust ecosystem growth.

Solana Reclaims $200 as New Buyers Fuel Rally

Solana surged past $200 with a 21% gain, buoyed by strong technical indicators and fresh capital inflows. The token's daily Relative Strength Index (RSI) sits at 67.97—well below overbought territory—suggesting sustained bullish momentum.

New demand is accelerating. Glassnode data shows a 51% spike in first-time SOL transaction addresses since August 3, signaling growing retail participation. Market structure mirrors early phases of previous altcoin rallies, where expanding user bases preceded extended upside.

KeepSolid Launches KS Coin: A Loyalty Crypto Reward with Real Utility Token Benefits

KeepSolid, a leading developer of privacy tools, has introduced KS Coin, a Solana-based utility token designed to power its new Web3-enabled loyalty program. Priced at $0.007 per token with a 30% discount available until August 21, KS Coin offers users real ownership—unlike traditional loyalty points confined to a single ecosystem.

The token enables rewards for interactions with KeepSolid’s security tools, including VPN Unlimited and Passwarden. Future applications, such as a Web3 browser with VPN support and an encrypted messenger, will also integrate KS Coin. Purchases are currently available on KeepSolid’s website, with plans for expansion to select crypto platforms.

"KS Coin reflects our belief that users should benefit from and participate in our growth," said KeepSolid’s Founder and CEO. The token serves as both a loyalty reward and a gateway to deeper engagement with the company’s ecosystem. Earning mechanics include regular app usage and multi-platform installations.

Nasdaq-Listed Upexi Appoints Arthur Hayes to Bolster Solana Strategy

Upexi, a Nasdaq-listed firm, has intensified its commitment to Solana by establishing a new advisory committee and naming Arthur Hayes, CIO of Maelstrom Fund, as its inaugural member. The move underscores the company's aggressive positioning in the crypto space, leveraging Hayes' expertise in digital assets and institutional finance.

The company's treasury now holds over 2 million SOL, acquired through strategic purchases and capital raises. At current valuations, the stash is worth hundreds of millions of dollars. Upexi is further maximizing returns by staking its SOL holdings to generate yield, creating a steady income stream while maintaining long-term exposure.

Hayes' appointment signals Upexi's ambition to refine its Solana strategy, enhance visibility, and attract capital for future acquisitions. The advisory committee will focus on partnerships and fundraising initiatives tied to the firm's growing crypto treasury.

SEC Advances Review of Invesco Galaxy Spot Solana ETF Filing

The U.S. Securities and Exchange Commission has acknowledged receipt of Invesco Galaxy's application for a spot Solana ETF, marking a critical step toward potential approval. The filing, submitted via Cboe BZX Exchange's FORM 19b-4, now enters the regulator's formal review pipeline amid growing institutional interest in SOL-based products.

This development follows REX Shares' May filing for a similar product and aligns with pending applications from VanEck, Fidelity, and six other major issuers. Market participants anticipate decisions by October, buoyed by political tailwinds and the existence of CME-listed Solana futures contracts that strengthen the case for spot ETF approval.

While the SEC maintains cautious deliberation, the crypto ecosystem views this procedural milestone as validation of Solana's maturing market infrastructure. The regulator's measured approach contrasts with industry optimism, creating tension between institutional demand and compliance requirements.

Solana Surges 13% as Network Activity Fuels Rally Beyond $200

Solana's SOL token jumped 13% in 24 hours, breaching $201 amid surging network metrics. Stablecoin trading volume hit $1.2 billion—a four-month high—while daily revenue reached $163,400, marking August's peak. The blockchain's growing utility coincides with sector-wide stablecoin developments, including Circle's new L1 chain.

Transaction counts and active addresses continue climbing, reinforcing analysts' $252 price target. SOL has gained 18% monthly as real user adoption outpaces speculative trading. The network's revenue model demonstrates sustainable growth beyond meme coin volatility.

Solana Targets $225 Amid Coinbase-Squads USDC Partnership Boost

Solana (SOL) rallied 5% following Coinbase's collaboration with Squads Protocol to enhance USDC adoption across its blockchain. The partnership leverages Squads' Multisig platform, which already secures over $1 billion in USDC and processes $5 billion in stablecoin transactions.

"We're excited to support Squads as they integrate USDC deeper into Solana's ecosystem," said Shan Aggarwal, Coinbase's Chief Business Officer. The MOVE comes as SOL's MACD indicator crosses above its moving average, signaling potential upside toward $225.

Solana now ranks as the fourth-largest blockchain by stablecoin supply, with institutional adoption accelerating through strategic infrastructure partnerships.

Will SOL Price Hit 200?

SOL has a high probability of testing the $200 level based on both technical and fundamental factors:

| Factor | Data | Implication |

|---|---|---|

| Current Price | $192.75 | 4% below $200 target |

| 20-day MA | $177.43 | Strong support base |

| Upper Bollinger | $199.63 | Immediate resistance |

| MACD | Positive crossover | Bullish momentum |

| Network Activity | Surge in transactions | Fundamental support |

Michael from BTCC emphasizes: 'The confluence of technical breakouts, whale accumulation, and institutional ETF interest creates a bullish setup. While profit-taking may cause volatility near $200, the overall trajectory favors an upside resolution.'

Key risk: Failure to hold $185 support could delay the $200 test.